SOL Price Prediction: Analyzing Investment Potential Through Technical and Fundamental Lenses

#SOL

- Technical Positioning: SOL trades below moving average but shows potential reversal signals in MACD histogram

- Fundamental Catalysts: Strong institutional adoption through tokenization projects and potential ETF speculation

- Market Sentiment: Analyst projections reaching $500 with multiple growth catalysts identified for 2025

SOL Price Prediction

SOL Technical Analysis: Current Position and Trend Indicators

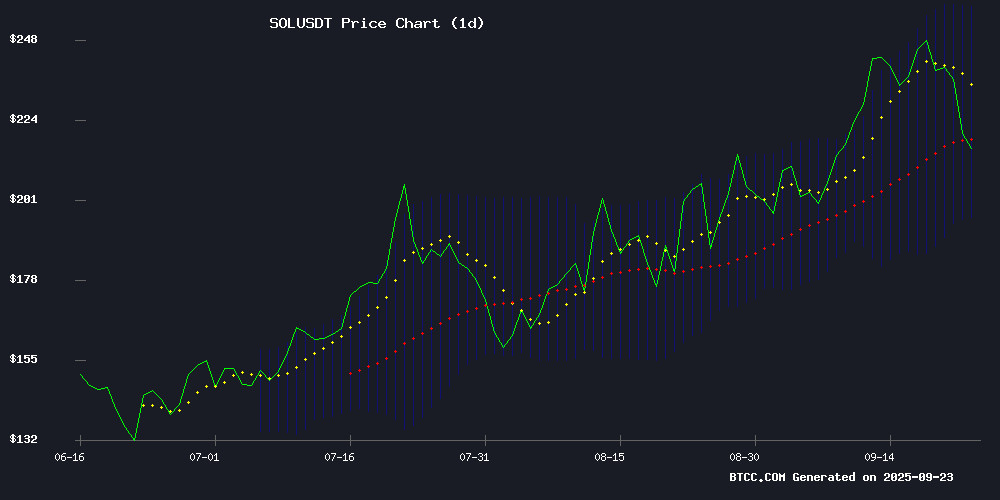

SOL is currently trading at $216.17, below its 20-day moving average of $226.75, indicating short-term bearish pressure. The MACD reading of -16.14 shows negative momentum, though the histogram turning positive at 0.57 suggests potential trend reversal. Bollinger Bands position SOL NEAR the middle band with resistance at $257.22 and support at $196.28.

According to BTCC financial analyst John, "The technical setup shows SOL in consolidation phase with key resistance at the upper Bollinger Band. A break above $257 could signal renewed bullish momentum."

Market Sentiment: Bullish Catalysts for SOL

Positive news flow dominates SOL's ecosystem with institutional adoption accelerating. Forward Industries' $1.65B stock tokenization on solana and South Korea's potential treasury acquisition highlight growing enterprise adoption. Multiple analysts project significant upside, with price targets reaching $500 amid ETF speculation.

BTCC financial analyst John notes, "The convergence of institutional interest and technical improvements positions SOL for potential growth, though current technical levels suggest cautious Optimism in the near term."

Factors Influencing SOL's Price

Forward Industries to Tokenize $1.65B Stock on Solana via Superstate Partnership

Forward Industries is set to tokenize $1.65 billion of its stock on the Solana blockchain, marking a significant step in bridging traditional equity with decentralized finance. The initiative, facilitated by Superstate's Opening Bell platform, will enable 24/7 trading and instant settlement of tokenized FORD shares.

The tokenized shares will also be usable as collateral in DeFi lending protocols, further integrating traditional finance with blockchain infrastructure. This move follows a $1.65 billion private placement in September, backed by notable investors including Galaxy Digital, Jump Crypto, and Multicoin Capital.

Solana's high-speed blockchain was chosen for its scalability and low transaction costs, positioning Forward Industries at the forefront of equity tokenization. Shareholders will be able to convert common stock into tokenized FORD shares, unlocking new liquidity opportunities and faster settlement times.

Solana and Remittix Tipped for Explosive Growth as Crypto Experts Predict 30x Rally Before December

Solana and Remittix are emerging as focal points for crypto analysts anticipating significant rallies in Q4 2025. While Solana maintains its position as a high-performance blockchain, Remittix—dubbed 'XRP 2.0'—is gaining traction as a dark horse with potential for exponential gains.

Solana's price stability near $236 reflects institutional confidence, underscored by a $1.65 billion ETF commitment and technical upgrades like Alpenglow. Yet, its mature valuation raises questions about achieving a 30x return by year-end.

Remittix, however, presents a nascent opportunity. With $26.2 million raised in its PayFi token sale and a focus on global payments, analysts highlight its asymmetric upside potential. The project's early-stage momentum mirrors patterns seen in prior breakout assets.

Solana Price Outlook and DeepSnitch AI Presale Potential

Solana (SOL), trading at $239 as of September 21, remains a focal point in the Layer-1 blockchain space. Its low transaction costs and expanding DeFi and Web3 adoption fuel bullish projections. Analysts suggest a potential doubling or tripling in price by year-end, contingent on successful network upgrades like Firedancer and sustained institutional interest. Yet, competition, regulatory hurdles, or technical failures could anchor SOL near current levels or push it to $160.

While a $5,000 SOL investment might yield $15,000 in an optimistic scenario, emerging presales like DeepSnitch AI present hyperbolic return potential—$5,000 could balloon to $500,000. Solana’s DeFi TVL growth and institutional inflows signal strength, but its historical network instability lingers as a cautionary note.

Hyperliquid Faces Rising Competition in On-Chain Derivatives Market

Hyperliquid's dominance in on-chain derivatives is under threat as new competitors emerge from Solana and Arbitrum ecosystems. Drift Protocol leverages Solana's speed to deliver centralized-like performance with decentralized integrity, while Aster—backed by YZi Labs—bridges crypto and traditional finance through perpetuals on real-world assets.

The architectural arms race intensifies as these platforms challenge Hyperliquid's throne. Each contender brings distinct strategic advantages, from zero-knowledge proofs to high-throughput chains, reshaping the future of decentralized trading.

Solana and BlockchainFX Emerge as Top Picks for 2025 Crypto Portfolio

Solana (SOL) and BlockchainFX (BFX) are capturing investor attention as the crypto bull market gains momentum. Solana, known for its speed and scalability, has rebounded from a June low of $126 to $244, with analysts eyeing $250 as the next resistance level. The network's robust developer activity and growing adoption underscore its resilience.

Meanwhile, BlockchainFX is drawing presale interest with ambitions to become the first global crypto trading super app. Its early-stage growth potential contrasts with Solana's established ecosystem, offering investors divergent opportunities. Market sentiment suggests both assets could outperform in 2025.

South Korea Set for First Public Solana Treasury Acquisition Backed by Fragmetric & DFDV

Fragmetric Labs and Nasdaq-listed DeFi Development Corp (DFDV) are collaborating to establish South Korea's first Solana-based digital asset treasury. The partners plan to acquire a publicly listed Korean company to facilitate this initiative, marking a significant step in institutional blockchain adoption.

The project aims to create new investment vehicles leveraging Solana's high-performance infrastructure. Fragmetric's Normalized Token Program will enable creation of fragSOL using liquid staking tokens, including dfdvSOL, further expanding DeFi ecosystem integration.

This strategic move positions Solana at the heart of South Korea's financial infrastructure, potentially accelerating mainstream crypto adoption in Asia's fourth-largest economy. The treasury acquisition signals growing institutional confidence in blockchain-based asset management solutions.

PancakeSwap Integrates Relay Protocol for Instant Cross-Chain Swaps on Solana and Other Major Networks

PancakeSwap has rolled out instant cross-chain token swaps by integrating Relay Protocol, now supporting Solana alongside six other leading networks: BNB Chain, Arbitrum, Base, Ethereum, ZKsync, and Linea. This upgrade eliminates the need for bridges or multiple applications, allowing users to execute seamless cross-chain trades in seconds.

The move significantly reduces costs and counterparty risks while accelerating DeFi's multichain evolution. PancakeSwap's latest feature targets the growing demand for frictionless interoperability, positioning itself as a frontrunner in simplifying complex cross-chain transactions.

Solana Price Prediction: Analysts Target $500 Amid ETF Speculation

Solana's price surge to $250 this year reflects robust network activity and institutional interest. Analysts now project a potential climb to $500, driven by expectations of a spot ETF approval. The blockchain's transaction efficiency and developer appeal strengthen this bullish case.

Whale accumulation of $380 million in a single week underscores growing confidence. While Solana dominates DeFi and NFT sectors, retail investors are weighing alternatives like MAGACOIN FINANCE for higher-risk, high-reward opportunities.

Is SOL a good investment?

Based on current technical and fundamental analysis, SOL presents a mixed but leaning positive investment case. The token trades below its 20-day MA at $216.17, showing short-term weakness, but strong fundamental catalysts suggest potential recovery.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $216.17 vs $226.75 | Bearish Short-term |

| MACD Histogram | +0.57 | Potential Reversal |

| Bollinger Position | Middle Band | Neutral |

| Key Resistance | $257.22 | Breakout Target |

| Key Support | $196.28 | Risk Level |

BTCC financial analyst John suggests, "While technicals show consolidation, the strong institutional adoption news and ETF speculation create favorable conditions for medium-term growth. Investors should monitor the $257 resistance level for confirmation of bullish momentum."